728x90

- Females lead increase in spending, with all female spend +9% Y/Y lead by clothing +15% and footwear +16%

- 53% of teens cite Amazon as their No. 1 favorite e-com site (-300 bps Y/Y); Importantly, Amazon decreased from 47% share to 35% Y/Y among upper-income females

- Nike is the No. 1 apparel brand for teens & LULU gains 300 bps Y/Y; Nike is the No. 1 footwear brand—up 400 bps Y/Y

- For payment apps, Apple Pay ranked first, partly due to 87% of teens in the survey saying they have an iPhone

- PYPL’s Venmo ranked No. 2 (with the PayPal app No. 4) behind Apple Pay among payment apps used in the last month while SQ’s Cash App ranked No. 3

- For buy now pay later (BNPL), teens said they used PayPal “Pay in 4” most frequently, followed by SQ’s Afterpay

- While 26% of teens own a VR device, just 5% use it daily. 48% of teens are either unsure or not interested in the Metaverse

- Teens' interest in plant-based meat is slipping; 43% consume or are willing to try it, down from 49% in Spring 2021

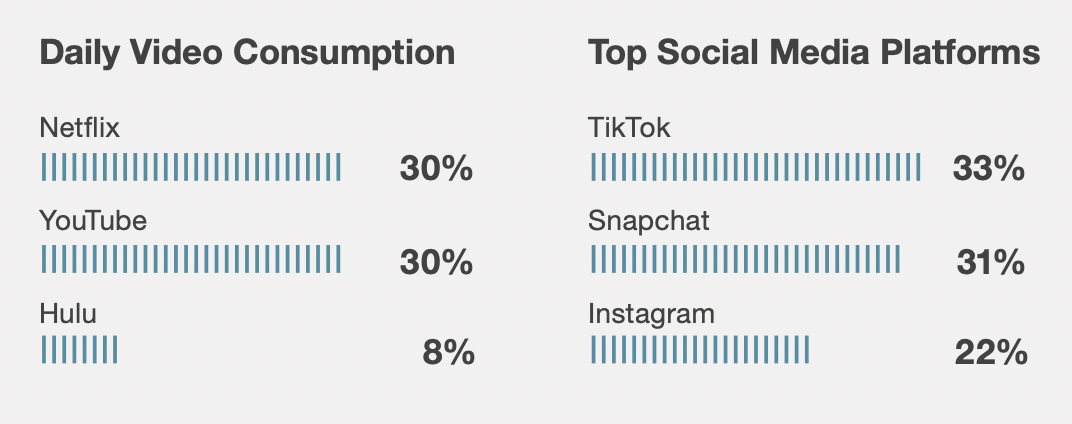

- Teens spend 30% of their daily video consumption on Netflix and YouTube (both 30%); HBO Max gained share

- TikTok is the favorite social media platform (33% share) surpassing Snapchat for the first time (31%); Instagram was again third (22%)

728x90